As digital fraud becomes more sophisticated, banks are turning to artificial intelligence not just to detect crime but to predict and prevent it.

Fraud Analyst and Financial Crime Specialist Joy Ladegbaye, in a her latest report stated that the fight against fraud is no longer about reacting to threats after they occur, but building intelligent systems that anticipate them.

Ladegbaye noted that with the right mix of solid data, advanced machine learning models, real-time monitoring, and human insight, financial institutions can finally shift from playing defence to taking the offensive against fraudsters who never stop innovating.

“Fraud will never disappear, and fraudsters will never stop innovating but with well-designed AI systems built on solid data, advanced models, continuous monitoring, and human oversight banks can do more than react.

“The battle isn’t over, but we’re shifting from defence to offence. AI doesn’t just help us keep up with criminals it gives us the chance to get ahead.”.

Meanwhile, Ladegbaye explained that As fraudsters become more advanced, using bots, AI, and deepfakes, banks should turn to artificial intelligence not just to catch fraud but to predict and prevent it.

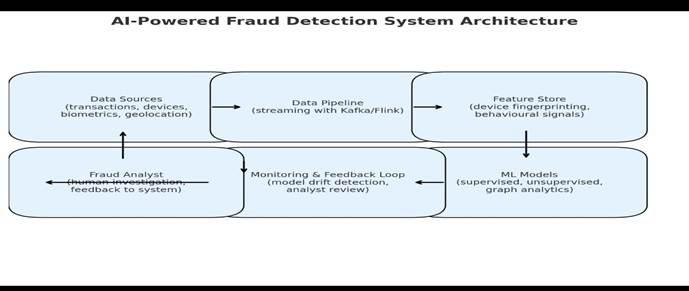

She explained that to achieve this systems must be built on solid data, including real-time transaction streams, device info, and behavioural signals adding that tools like Apache Kafka and Flink help process this data instantly.

Continuing she said banks need real-world models fast, accurate, and explainable techniques like supervised learning, unsupervised anomaly detection, and graph models are essential including Hybrid systems combining AI and rules ensure flexibility and regulatory compliance.

Meanwhile, Ladegbaye opined that success isn’t just about catching more fraud but about balance adding that key metrics like precision, false positive rate, and latency help protect both the bank and its customers.

“With the right AI systems, banks can do more than react, they can stay ahead.”. She added