BARRING any last-minute decision from the government, on January 1, Nigerians will enter a new tax regime that seeks to use digital tools to bring more people into the tax net through a centralised system.

The new regime, however, offers a fresh breath of life into the harmonised tax system structure in Nigeria, which removes multiple taxation and digitises payment, leaving some tricky, unsolved questions for corporate businesses and private entities.

The new tax law in Nigeria, signed on June 26, 2025, aims to simplify tax compliance, reduce multiple taxation, and increase revenue generation.

Background

The ICIR reported in June that the new bills had been signed into law by President Bola Tinubu. The bills that were signed into law were the Nigeria Tax Bill, the Nigeria Tax Administration Bill, the Nigeria Revenue Service (Establishment) Bill, and the Joint Revenue Board (Establishment) Bill.

Now an Act, the Nigerian Tax Act aims to merge the country’s tax laws into a single, unified system, while the Nigerian Tax Administration Act creates uniform procedures for tax collection across federal, state, and local governments, replacing the current patchwork of different systems.

Under the new law, the Nigeria Revenue Service (Establishment) Act gives the tax collection agency greater independence and expanded powers, including collecting non-tax revenue.

The Joint Revenue Board (Establishment) Act will set up formal cooperation structures between different levels of government and create oversight bodies, including a Tax Appeal Tribunal and the Office of the Tax Ombudsman.

These reforms aim to boost revenue, simplify tax administration, and promote economic growth.

How companies would be taxed under the new regime

The Company Income Tax (CIT) has been reduced from 30 per cent to 25 per cent for medium and large firms starting in 2026, with a transitional rate of 27.5 per cent in 2025.

On Value-Added-Tax (VAT) exemption, essential items like food, medical services, and education are zero-rated.

The new regime has a development levy of 4 per cent on assessable profits, consolidating previous taxes.

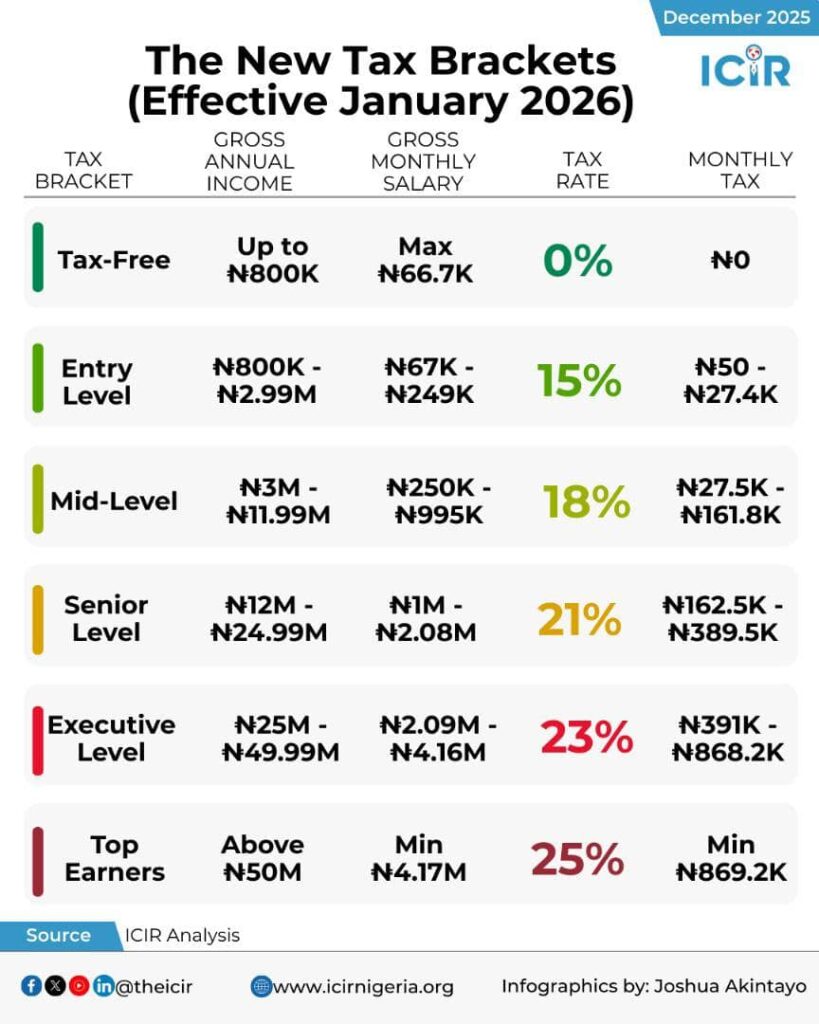

Infographic for tax ands what is payable from January 1

On the minimum effective tax rate, the new regime taxes 15 per cent for multinational groups with annual turnover above ₦50 billion.

Accordingly, the Capital Gains Tax was also increased from 10 per cent to 30 per cent for companies.

What do businesses stand to benefit?

The harmonised tax system simplified the tax structure and reduced the compliance burden to businesses through digital compliance and tax agents working at the Nigerian Revenue Service.

It also increased input VAT recovery for service-oriented industries. There are also exemptions for small businesses with an annual turnover below ₦100 million.

The new regime also targets improved transparency and accountability because of digital emphasis, which is enhanced through financial statements of companies and information they share with the Corporate Affairs Commission (CAC)

“Yes, there is seamless information management between the Federal Inland Revenue Service and the Corporate Affairs Commission for proper tracking of tax compliance and companies’ annual returns,” a notary public and a CAC consultant lawyer, Inemesit Eyibo, told The ICIR.

Some knotty areas and solutions from stakeholders

As Nigerian companies gear up to enter the New Tax regime, tax stakeholders have advised firms and corporate entities to get the services of a tax consultant to avoid possible pitfalls.

The stakeholders submitted Abuja Business Tax Roundtable 2025, organised by the Abuja

Chamber of Commerce and Industry (ACCI) with the theme: “Demystifying the New Tax Laws,” on Tuesday, November 25.

Speaking at the event, the Vice President of ACCI, Adesoji Adesugba, said, businesses are still asking critical questions about the new tax law.

“What are the opportunities, efficiencies and competitive edge it offers. How does it affect businesses?

An official of Federal Inland Revenue Service FIRS-Kenhinde Kajesomo, in allaying fears of business representatives at the event, said, “The government will tax fruits, not seed.”

He added that there are tax agents who assist with solutions to problems at tax offices nationwide.

“With these reforms, there is a harmonisation of different tax laws. Registration, filing of returns, all of them simplified to aid compliance,” he said.

He further said that the reforms are majorly data-driven, noting that there’s economic alignment in the new tax law.

What to know about the new tax law

The ICIR reports that the effective implementation date will be January 1, 2026, meaning that it will affect tax return filings of 2026 financial statements, so it’s not going to be immediate.

For Small and Medium Enterprises (SMEs), the zero tax threshold has been increased from 25 million to 50 million. Small companies with 0 to 50 million turnovers are now 0 per cent tax.

Companies with a turnover above 50 million will be taxed at the rate of 30 per cent.

“Small company” means a company that earns gross turnover of N50,000,000 or less per annum with the total fixed assets not exceeding N250,000,000.

However, businesses providing professional services shall not be classified as small companies.

The ICIR noted that in the new tax law, there’s no withholding tax deduction on business income of small businesses, and no VAT filing requirements to deduct and account for tax payments to vendors.

Areas of possible confusion for taxpayers

For a tax consultant and member of the Institute of Chartered Accountants of Nigeria (CITN), Emeka Okoroeze, primary areas of concern are whether the new regime will be able to truly improve revenue generation by bringing more people and businesses into the tax net and strengthen the economy, as some believe that given incentives might not be enough to help the real sector.

“For instance, a situation where individuals who earn up to 2million face tax payment at 15 per cent and business turnover below 50 million pays zero tax remains a huge worry,” Okoroeze said.

For the management of Palm Bridge Concepts Limited, Ebuka Onyeneke, a loan facility of N500 million borrowed from a deposit money bank could create a huge economic problem for the firm if they hadn’t sought advice from a tax professional who guided them on how to properly designate their loan facility away from their sales and other transactions in their company’s financial statement.

“We have been asking relevant questions about the new tax law and our transactions. Our lawyer guided us on what to do to avoid pitfalls, and that saved us when we eventually submitted our financial statements to the relevant authorities,” Victor Inemesit, a lawyer who offers commercial advisory to Palmbridge Concepts Limited, told The ICIR.

A tax consultant and an Associate Professor of Taxation, Kennedy Iwundu, told The ICIR on the sidelines of a recent tax event that companies must properly delineate borrowed facilities from sales in their financial statements to avoid possible sanctions from tax authorities.

He said: “When you borrow a facility from the bank, ensure you get your company board to officially approve that loan, ensure it reflects in your financial statement as a loan facility and properly delineate that it’s not sales, adding that ‘Through proper delineation in the financial statements, you can avoid the trap of tax offence.”

Iwundu urged Nigerian companies to seek a tax consultant’s interpretation of the new law, since there could be areas of ambiguity.

“Seek the advice of a tax agent and consultant as provided in the law. For instance, Section 11 of the new tax law says all companies must file tax returns. Section 13 says all individuals must file in tax return. This could be confusing, and a tax expert could guide individuals who think they’re exempt in ways of going about this,” he said.

He also suggested that companies write the FIRS in some difficult transactions.

A representative of the Manufacturers Association of Nigeria (MAN), Chigozie Igwe, urged government officials to manage the narrative, adding that there is still serious fear about the whole tax issue.

“No economy has been built on the back of taxes alone. We must control the narrative out there- that of fear. Tax is a social contract. The government should as much as it can highlight the benefits for businesses and corporate entities to understand that it is a win-win,” Igwe said.

Other issues with the New tax law

The ICIR reports that under the new tax law, there is the Economic Development Tax Incentive (EDTI), which applies to specified priority sectors such as the manufacture of electrical equipment, chemical, pharmaceutical products, motor vehicles, metal, iron, steel, electricity and gas supply, renewable energy, music, and video production.

The ICIR findings have shown that the qualifying Capital Expenditure threshold for EDTI ranges from ₦250 million to ₦500 million, depending on the sector.

Companies granted the EDTI can enjoy annual tax credits of 5 per cent of the acquired QCE, for five years.

EDTI can be extended for an additional five years, where profits generated during the

incentive period are wholly reinvested in

the business for expansion.

Offences for taxes, file returns failures

Key offences in the new Act include failure to grant access for the deployment of technology; Failure to deduct tax; Failure to remit tax deducted at source or self-account; Failure to attend to demands, requests or notices.

The ICIR reports that taxpayers may file a written notice of objection within 30 days of receiving an assessment, and the tax authority must respond within 90 days; otherwise, the taxpayer’s objection is deemed upheld.

In the new tax act, there is a seamless collaboration between different tax authorities, including joint tax audit exercises, to ensure compliance.

Taxpayers may claim a refund of overpaid taxes following an audit by the relevant tax

Authority and the approved refunds must be made within 90 days of decision of the tax authority or set-off against any tax liability.

Taxation of dividend Profits of a Nigerian company assessment shall also include the gross amount of the received dividend

Where a dividend is paid to a Nigerian company in the form of shares, such a Payment will not be subject to withholding tax.